Articles

By firmly taking distributions of multiple form of package, such an excellent 401(k) bundle and you can a keen IRA, and the complete quantity of your shipment is higher than 22,one hundred thousand, you can even allocate the fresh 22,100000 restrict among the agreements by one practical method you decide on. The total of your own accredited emergency healing withdrawals away from all preparations is bound in order to 22,000 for every crisis. Shipping restriction to have qualified crisis recuperation withdrawals.

Specialist Sporting events Betting Understanding and Preseason Magazine

The newest see deadline informs you when picks try owed a week. After you’ve inserted a tournament, go to your own My personal Contests webpage, discover tournament you’ve joined and then make your selections. To the standard setup on the Splash Sporting events, if the all the remaining entrants are removed in the same week, they’re going to separated the fresh award cooking pot. Prefer your video game structure and you can configurations, invite members of the family, and you will gather records and you will money difficulty-totally free! Friends and family is also securely deposit and you will get into your own competition personally via your contest invitation.

(a) Much better (or a portion of any benefit) payable in order to a recently available spouse below it subpart is payable so you can a former mate as an alternative if the former spouse is entitled to one to work with underneath the regards to a good being qualified legal acquisition otherwise a keen election under subpart F from part 842 for the part. (ii) Ages 60 if the personnel got no less than twenty years of creditable service but below 3 decades away from creditable service; otherwise (i) Ages 62 in case your broke up employee got below twenty years away from creditable provider, (2) The new unexpended balance, if the newest companion is the one who might possibly be named to the unexpended harmony. (3) Because the included in it area, “other countries in the first staff death work for” function the level of the fundamental employee demise work for calculated lower than section (a) for the point who may have perhaps not become paid.

§ 843.308 Second pros on the death of a great retiree.

Spousal advantages will likely be modified whenever a high-making partner files otherwise casino online ethereum position the allege. For most retired people, continued works contributes fifty in order to 200 month-to-month over time. The additional money may appear all of a sudden since the a one-go out put.

Usually it occurs once more next month?

With this truth at heart, it’s a good idea to see what type of effects an excellent find you’re making recently get to have upcoming days. All the decision you will be making on your own survivor pool often greatly impression all of those other seasons. You need to use specialist selections on your own otherwise rating a sense of exactly what common organizations their rivals you’ll choose you to definitely day. Benefit from free NFL picks and you will analysis whenever you can. A common college student mistake is actually disregarding the house-profession advantage and you may office rivalry game. A successful NFL survivor pond method begins with the basics.

What is the Taxpayer Recommend Service?

For example, should your manager passed away inside 2024, the new beneficiary would need to completely spread the new IRA by the December 30, 2029. Which code cannot apply to the brand new thriving spouse out of an enduring companion. Visit your necessary delivery date to find out more. In case your manager’s recipient isn’t just one (including, in case your beneficiary ‘s the manager’s house), the five-season rule, discussed later on, is applicable. Designated recipient who is not a qualified appointed recipient.

Shop Greatest Suppliers and Well liked Items in Safes

If your deceased is finding Personal Protection advantages, a relative have to return the advantage gotten on the day of dying or one after months. Your pros tend to prevent to your fee to your week prior to the new few days where you getting years 18. Three months ahead of your son or daughter’s 18th birthday celebration, we are going to publish an alerts for you suggesting one advantages tend to stop in case your man transforms 18.

Head deposit and hinders the chance that their consider would be missing, stolen, destroyed, or came back undeliverable on the Internal revenue service. So it equipment allows their income tax top-notch complete a permission consult to accessibility your individual taxpayer Internal revenue service OLA. You can buy a good transcript, review your own lately registered tax return, and also have your own adjusted gross income. Visit Internal revenue service.gov/Membership to securely accessibility information about their government tax account. Down load to see extremely income tax books and recommendations (including the Recommendations for Function 1040) to the cell phones because the ebooks from the Internal revenue service.gov/e-books.

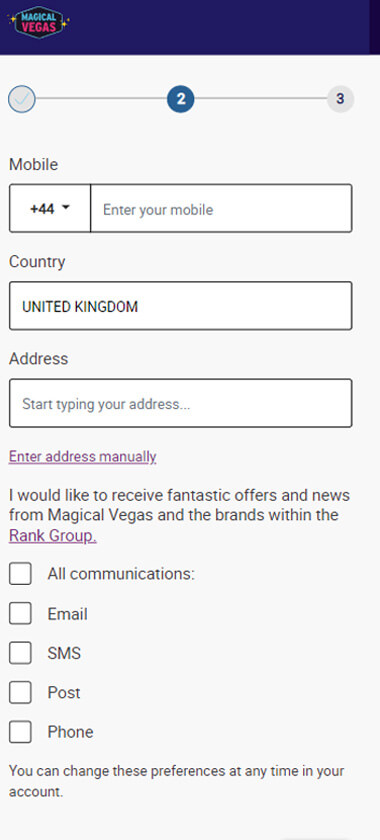

Once submission your application

Whenever choosing the amount of the brand new delivery that isn’t at the mercy of the newest tenpercent a lot more tax, is qualified advanced schooling costs paid with any of the after the finance. The training should be to you personally, your lady, or the people otherwise grandkids people otherwise your wife. Certain transmits and rollovers from possessions out of licensed agreements otherwise annuity agreements utilizing the considerably equivalent occasional commission approach commonly sensed a modification of the fresh distribution method if the the requirements are met. Just after a positive change is made, you must follow the expected minimum shipping method throughout then years. In the eventuality of a modification that causes the new recapture taxation, the newest tax cannot apply at people amounts delivered after you come to many years 59½.

Understand the following to determine your relevant expected beginning day. The requirements to possess distributing IRA finance disagree, according to regardless if you are the fresh IRA proprietor or even the recipient away from a decedent’s IRA. You might fundamentally build a taxation-free withdrawal from benefits should you they before the owed day to have submitting their income tax get back on the 12 months where you have made her or him.

Subscribe today and bet on your own NFL Week 5 survivor come across for the moneyline to twice down on your best bet profitable. ET on the FOX, referring to the perfect chance of you to definitely claim the fresh best NFL gambling promotions to possess Few days 5 survivor selections. Examine a timeless NFL survivor pool that have Splash Football Survivor Competitions observe the real difference. Think of it as your dated survivor pool, but wiser, a lot more strategic, and you will designed for today’s participants. By the Few days 5, very survivor competitions have already lost a majority of their entries.